What Caregivers Need to Know About Estate Planning for a Loved One With Dementia – Part 2

Last week, we started our discussion on estate planning for a loved one with a dementia diagnosis and what this means for their ability to protect their wishes through an estate plan. We covered: What it means to have mental capacity or be incapacitated How dementia affects capacity for estate planning purposes The essential estate […]

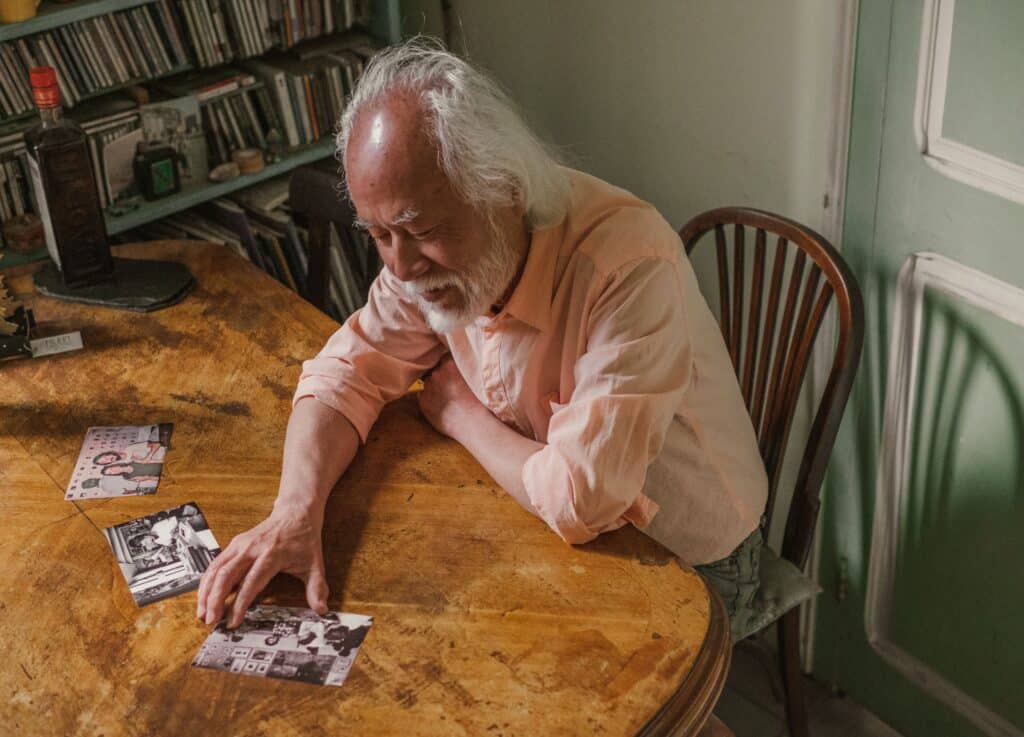

What Caregivers Need to Know About Estate Planning for a Loved One With Dementia – Part 1

Caring for a loved one with dementia is a challenge that millions of families undertake each year. As a caregiver, understanding how a dementia diagnosis affects your loved one’s legal decision-making is crucial to ensuring their wishes are honored and that you are providing them with the best possible care. In this blog, we’ll explore […]

3 Ways to Comfort and Support A Loved One in Mourning

Losing a loved one is an incredibly challenging experience, and the journey through grief can be both complex and overwhelming. Unfortunately, we all experience grief at one time or another, and knowing how to manage your own grief and how to be there for others who are grieving is an important skill that can improve […]

Roll Unused 529 College Savings Into a Roth IRA

In December 2022, Congress passed the SECURE 2.0 Act, bringing significant changes to the world of retirement savings and student loans. Two key parts of the Secure 2.0 Act are in effect, and they could substantially impact your family’s financial future. We’ll explain how the new law affects your unused 529 college savings account and […]

How To Pass On Family Heirlooms and Keepsakes Without Causing A Family Feud

When creating an estate plan, people are often most concerned with passing on the “big things” like real estate, bank accounts, and vehicles. Smaller items, like family heirlooms and keepsakes, which may not have a high dollar value, frequently have the most sentimental value for our family members. However, these personal possessions are often not […]

Protect Your Children’s Inheritance With A Lifetime Asset Protection Trust

As a parent, you’re likely hoping to leave your children an inheritance. In fact, doing so may be one of the primary factors motivating your life’s work. But without taking the proper precautions, the wealth you pass on is at serious risk of being accidentally lost or squandered due to common life events, such as […]

What You Need To Know About The Corporate Transparency Act Reporting Deadline

Business ownership is a fulfilling and exciting endeavor, but it also comes with rules, responsibilities, and reporting requirements that can be hard to track. If you own a small business or have a Trust that owns a business interest, you’ll need to comply with the Corporate Transparency Act (CTA). Beginning January 1, 2024, the Corporate […]

3 Things You Need To Know About Retirement Distributions

If you’re part of a blended family (meaning you are married with children from a prior marriage in the mix), you’re no stranger to the extra considerations and planning it takes to keep your family’s life running smoothly. You’ve also probably given some thought to what you want to happen to your assets and your […]

3 Tips For Discussing Finances With Your Family Over The Holidays

The holidays are right around the corner, which means more time to gather with family and relatives than any other time of the year. If you’ve been meaning to talk with your family about finances, inheritance, end-of-life decisions, estate planning, and creating a plan for your whole family’s wealth – now and in the future […]

Transition to Adulthood: The Legal Impact of Your Child Turning 18

Soon after the challenges of puberty and the excitement of high school, an even larger milestone looms: the 18th birthday. It marks your child’s transition from childhood to adulthood, and with it new responsibilities and rights. From a legal standpoint, this milestone also brings significant changes that every parent should be aware of. In the […]